Fannie Mae 3734 2018-2026 free printable template

Show details

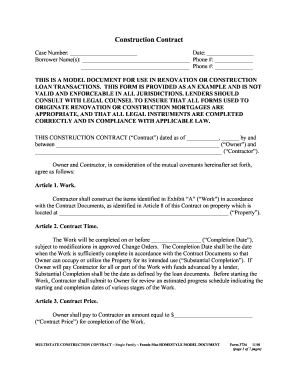

Owner will pay to Contractor an amount equal to Contract Price for completion of the Work. MULTISTATE CONSTRUCTION CONTRACT Single Family Fannie Mae MODEL DOCUMENT Form 3734 11/01 rev. 09/18 page 1 of 8 pages Article 4. THIS IS A MODEL DOCUMENT FOR USE IN FANNIE MAE CONSTRUCTION LOAN TRANSACTIONS* THIS FORM IS PROVIDED AS AN EXAMPLE AND HAS NOT BEEN EVALUATED FOR VALIDITY AND ENFORCEABILITY IN ANY JURISDICTION* LENDERS SHOULD CONSULT WITH LEGAL COUNSEL TO ENSURE THAT ALL FORMS USED TO...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form construction contract

Edit your fannie mae lender forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fannie mae site pdffiller com site blog pdffiller com form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing procureone fannie mae online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fannie mae loan delivery edits form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fannie Mae 3734 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out fanniemar form

How to fill out Fannie Mae 3734

01

Gather necessary documentation related to the property and borrower.

02

Start by filling out the borrower information at the top of the form.

03

Provide details about the property, including the address and loan number.

04

Complete the financial information section thoroughly.

05

Include any necessary disclosures or additional information as required.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

Who needs Fannie Mae 3734?

01

Individuals applying for a mortgage backed by Fannie Mae.

02

Borrowers seeking financial assistance or loan modifications.

03

Lenders and mortgage servicers who are processing Fannie Mae loans.

Fill

fannie mae visa types

: Try Risk Free

People Also Ask about

Does Fannie Mae require a 2 year employment history?

Length of Self-Employment Fannie Mae generally requires lenders to obtain a two-year history of the borrower's prior earnings as a means of demonstrating the likelihood that the income will continue to be received.

How to become a Fannie Mae contractor?

New Suppliers Step 1: Confirm your company provides goods or services that Fannie Mae purchases. Step 2: Confirm your company meets our minimum supplier qualifications. Step 3: Create a supplier profile in our Supplier Management System, ProcureOne, to let us know you are interested.

What are the benefits of a Fannie Mae loan?

Pros of Fannie Mae Loans Explained Qualification Guidelines Designed To Help More People Buy Homes. Low Down Payment Loan Options. Accepts Nontraditional Income Sources. Offers Different Types of Loans To Meet Your Needs. Mortgage Insurance Can Be Canceled. Possible Mortgage Insurance. Possible Income Limits.

What is the difference between Freddie Mac and Fannie Mae?

Mortgage Sourcing The primary difference between Freddie Mac and Fannie Mae is where they source their mortgages from. Fannie Mae buys mortgages from larger, commercial banks, while Freddie Mac buys them from much smaller banks.

What is the purpose of Fannie May?

Fannie Mae was chartered by U.S. Congress in 1938 to provide a reliable source of affordable mortgage financing across the country. Today, our mission continues to provide a stable source of liquidity to support low- and moderate-income mortgage borrowers and renters.

Can I contact Fannie Mae directly?

Contact the Fannie Mae Resource Center , or call 800-2FANNIE (800-232-6643), Option 4, if Fannie Mae owns your mortgage or for more information about a Fannie Mae lender.

What are the Fannie Mae guidelines?

Fannie Mae guidelines require the lender to review the property's title history and ensure it's clear of any prior ownership claims from previous owners or any judgments or liens, such as unpaid property taxes. Title insurance is required to cover the loan amount on the purchase or refinance of any Fannie Mae loan.

What is the main purpose of Fannie Mae?

Fannie Mae was chartered by U.S. Congress in 1938 to provide a reliable source of affordable mortgage financing across the country. Today, our mission continues to provide a stable source of liquidity to support low- and moderate-income mortgage borrowers and renters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find Fannie Mae 3734?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific Fannie Mae 3734 and other forms. Find the template you need and change it using powerful tools.

Can I sign the Fannie Mae 3734 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your Fannie Mae 3734 in seconds.

How do I edit Fannie Mae 3734 on an iOS device?

Create, edit, and share Fannie Mae 3734 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is Fannie Mae 3734?

Fannie Mae 3734 is a form used by lenders to report certain financial information related to the management of properties that are financed through Fannie Mae.

Who is required to file Fannie Mae 3734?

Lenders and servicers who manage loans and properties that are backed by Fannie Mae are required to file Fannie Mae 3734.

How to fill out Fannie Mae 3734?

To fill out Fannie Mae 3734, you must provide accurate financial data regarding property management, including income, expenses, and occupancy details. Follow the guidelines provided by Fannie Mae for accurate reporting.

What is the purpose of Fannie Mae 3734?

The purpose of Fannie Mae 3734 is to ensure compliance with reporting requirements and to provide transparency in the financial performance of properties financed by Fannie Mae.

What information must be reported on Fannie Mae 3734?

The information that must be reported on Fannie Mae 3734 includes property identification, financial performance details like rental income, operating expenses, and any relevant occupancy statistics.

Fill out your Fannie Mae 3734 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fannie Mae 3734 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.