Fannie Mae 3734 2018-2024 free printable template

Get, Create, Make and Sign

Editing fannie mae contract online

Fannie Mae 3734 Form Versions

How to fill out fannie mae contract 2018-2024

How to fill out a Fannie Mae contract:

Who needs a Fannie Mae contract?

Video instructions and help with filling out and completing fannie mae contract

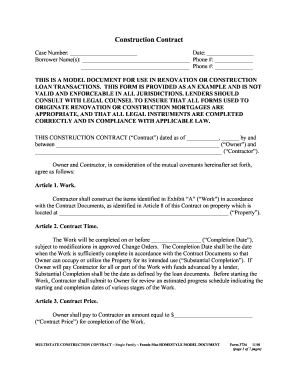

Instructions and Help about fannie mae construction loan forms

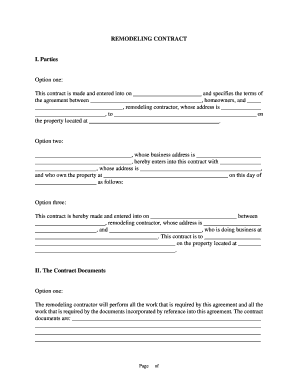

Welcome to Horizon palm realty group the following tutorial will assist you in properly completing your contract package for submission to our office we have identified for you the most common mistakes made to the Fannie make addendums and state contract that will delay receipt of your executed contract congratulations your offer has been successfully accepted step one our closing Department will be emailing you with full instructions to assist you in completing the important documentation your first step should be to print all documents prior to rewriting a new state contract to better familiarize yourself with what is required step 2 Fannie make real estate addendums the following are the most common errors sellers name must be Fannie make and nothing else buyers name must match both addendums and state contract and should be written as buyer will be taking title if this does not match stop and contact our office immediately inspection period begins on acknowledgement date is listed on page one of the addendums you will not have an executed contract until a few days after your contract has been submitted delays caused by Corrections is only giving your buyer less time to inspect please be sure to verify closing date on page 1 page 6 of the Fannie make real estate purchase addendums section F please ensure your buyer has made a selection by initialing not a check mark whether they are selecting the sellers title company or others make sure your buyer initials all pages of the addendum and signs page 12 to include requested information address telephone number email etc buyers agents please ensure your contact information is completed remember if there is a change that may be quire stop and call our office cross-outs on the addendums will not be accepted and will cause your contract package to be rejected the following section Florida far bar as is contract common errors made step 3 state contract please type your contract no handwritten contracts you can download a copy at Florida realtors org sellers name is always Fannie Mae and not owner of record verify buyers name matches bank addendums and confirm this is how title will be taken cross out personal property while Fannie make will not remove any personal property it is not part of the contract and must be crossed out verify sale price and closing date all information on bank addendums must match including any financing page 2 line 81 item 7 assign ability you must select may not assign this contract page 3 line 158 under home warranty please make sure a selection is made by number 168 please select a seller shall pay installments page 10, section 20 pursuant clause must be included this clause is found in the original email that was sent to you with all attachments please copy and paste that clause into your state contract and last make sure your buyer properly signs the state contract and dates it include the buyers current address cooperating brokers please be sure to complete your...

Fill form 3734 contract : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your fannie mae contract 2018-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.